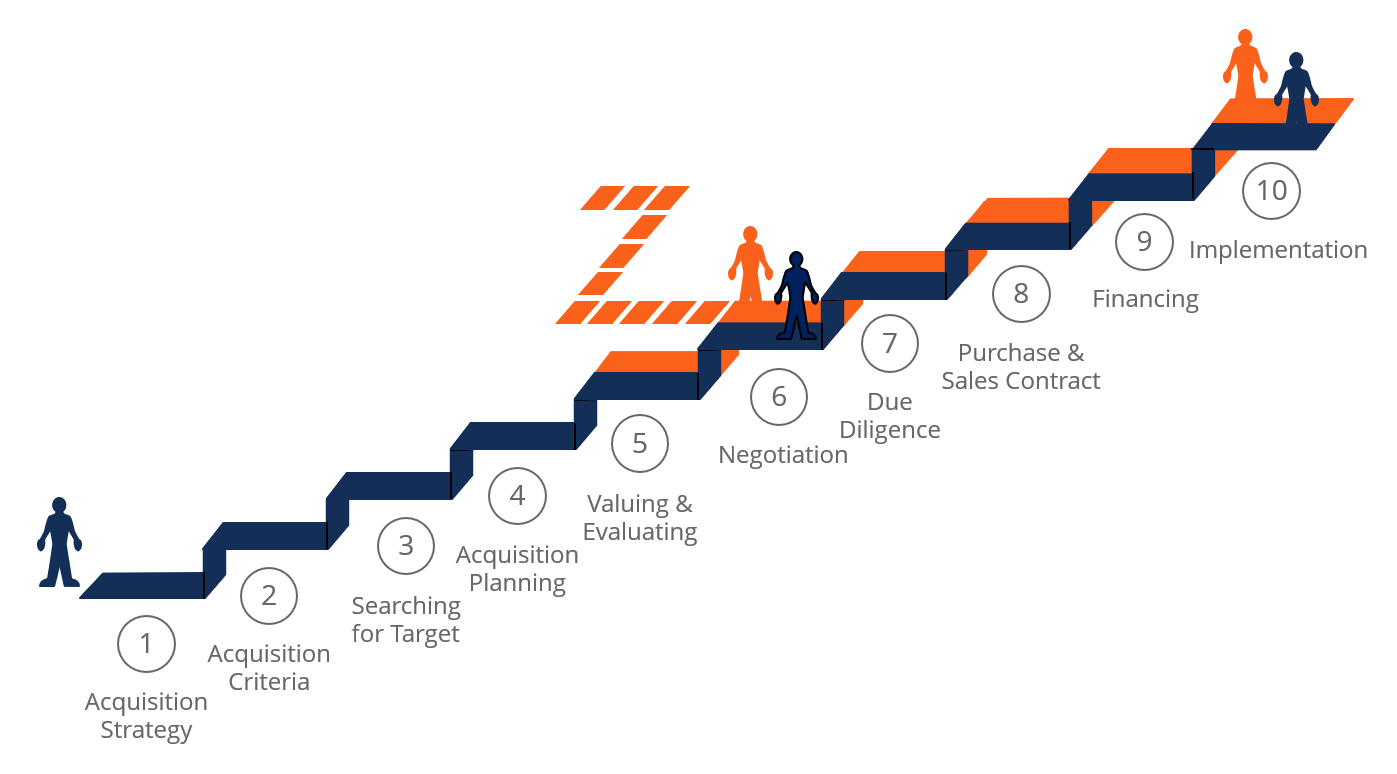

There's only one real way to achieve massive growth literally overnight, and that's by buying somebody else's company. Acquisition has become one of the most popular ways to grow today. The mergers and acquisitions (M&A) process has many steps and can often take anywhere from 6 months to several years to complete.

Companies choose to grow by acquiring others to increase market share, to gain access to promising new technologies, to achieve synergies in their operations, to tap well-developed distribution channels, to obtain control of undervalued assets, and a myriad of other reasons. But acquisition can be risky because many things can go wrong with even a well-laid plan to grow by acquiring: Cultures may clash, key employees may leave, synergies may fail to emerge, assets may be less valuable than perceived, and costs may skyrocket rather than fall. Still, perhaps because of the appeal of instant growth, acquisition is an increasingly common way to expand.

As you execute your company's growth strategy through acquisitions you will reach a number of decision points. From identifying target markets and potential targets to running an efficient transaction process and realising upside or synergy value, we help you confidently navigate the complexities of buying a business, unlocking value at every stage.

The different types of successful acquisitions include the below strategies:

Deal Structuring

One of the most complicated steps in the M&A process is properly structuring the deal. There are many factors to be considered, such as antitrust laws,

securities regulations, corporate law, rival bidders, taxes, accounting issues, contacts, market conditions, forms of financing, and specific negotiation

points in the M&A deal itself.

We help identify key risks and rewards throughout the acquisition life cycle, even for the most complex deals. We help you align deals with your strategic business objectives, maintain compliance and enhance value from integration and potential upside opportunity. Our team of specialists helps you focus on the key questions during the critical stages of planning and executing an acquisition.

We blend sophisticated capital markets expertise, with local market presence to negotiate customized financing packages that allow our clients to achieve their goals. We are particularly adept at advising on the following situations:

Our experienced team build robust, transparent financial models covering all circumstances and across a wide range of sectors. Our approach is to start with a clear understanding of the situation and design a bespoke model using proven methodologies and techniques. The advantages of our models include creating outputs and usability that are designed specifically for the user, as well as providing the flexibility of assumptions to perform sensitivity analysis.

This insight into current market practice ensures we negotiate the best deal for you throughout your transaction. Our team has the experience to help guide and support management teams through the process. We advise management teams on structuring, valuation, financing and tax planning and assist them to approach the vendor with a credible bid.

Our team can engage with you to:

Our experts partner with clients on corporate planning, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.